michigan gas tax increase 2021

Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as. Potential Increases and Reforms in 2021 Mackinac Center Policy Forum Virtual Event At the beginning of the last legislative term Gov.

Michigan Gas Prices Rose 42 Cents In One Week Hitting Highest Peak In Years Mlive Com

The tax rates for Motor Fuel LPG and Alternative Fuel are as follows.

. LANSING Gov. If 2021 inflation is 5 or more then the fuel tax will be increased to 277 cents per gallon. 1 and 280 million in 2021.

Gretchen Whitmer proposed a large tax hike. It will have a 53 increase due to a rounding provision specified in the calculations. At the same time gas prices are on the rise an increase in Michigan gas taxes went into effect on Sunday.

Michiganders would be paying double the state taxes they currently pay at the pump. The current state gas tax is 263 cents per gallon. A 45-cent tax increase per gallon of gas.

That revenue is expected to partially offset the revenue lost by unwinding the Snyder-era retirement tax which is estimated to cost the state close to 355 million in 2021. The bill in Virginia raised the gas tax by 10 cents. For fuel purchased January 1 2022 and after.

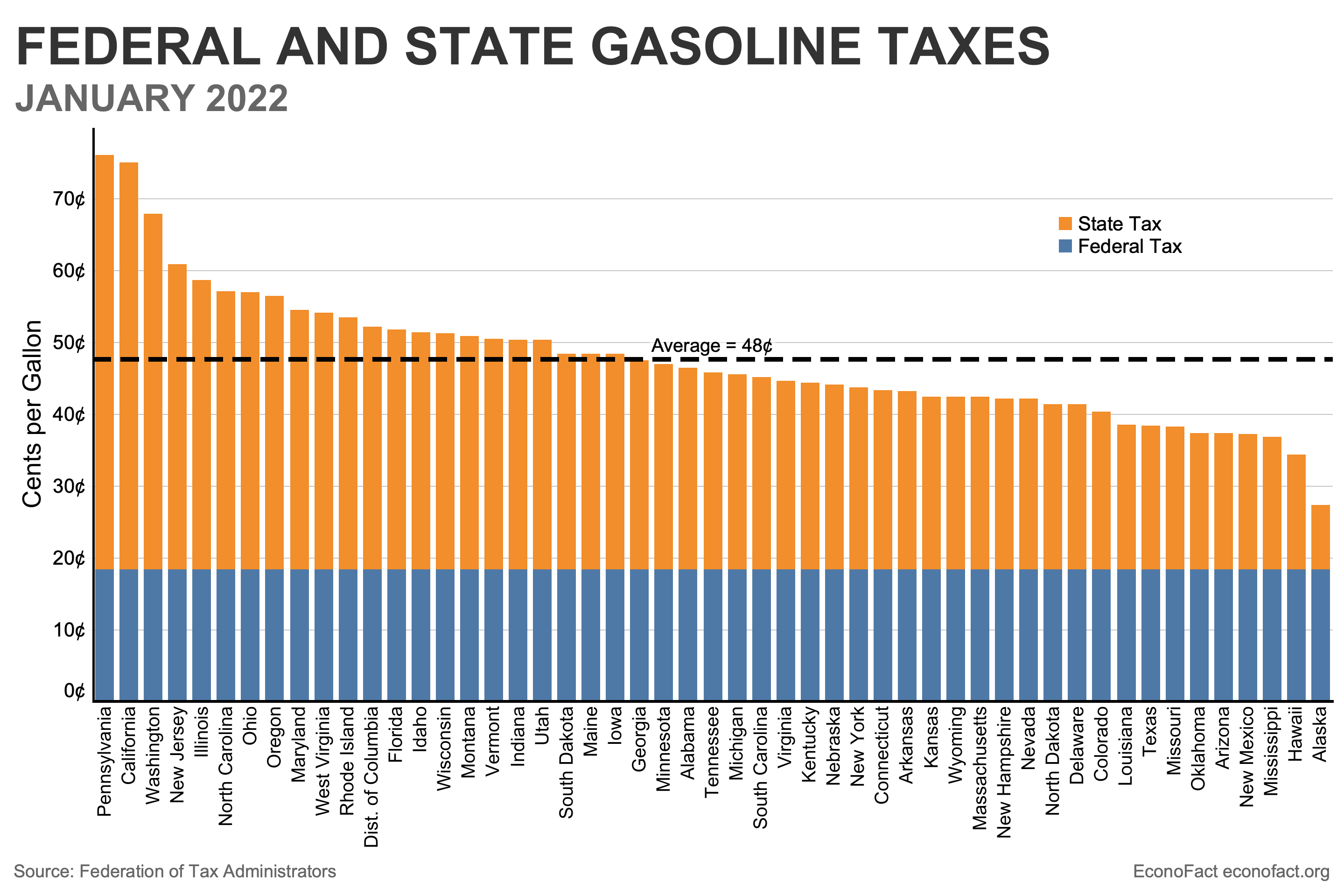

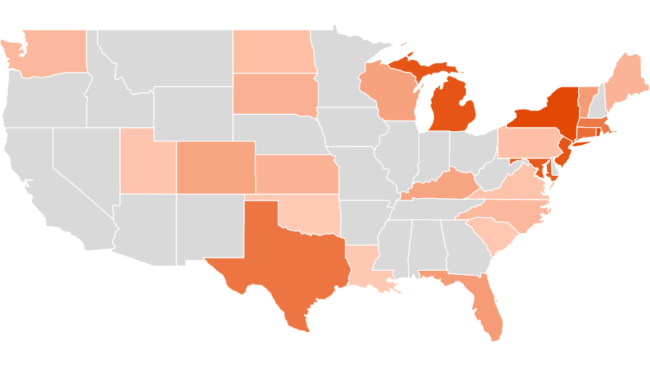

Most jet fuel that is used in commercial transportation is 044gallon. Brace yourselvesnatural gas prices are supposed to increase by an estimated third in the coming months and bring the total 2021 increase. In 2021 at a total of just over 45 cents combined per gallon Michigans gas tax was among the highest in the country at number 9 according to kiplinger.

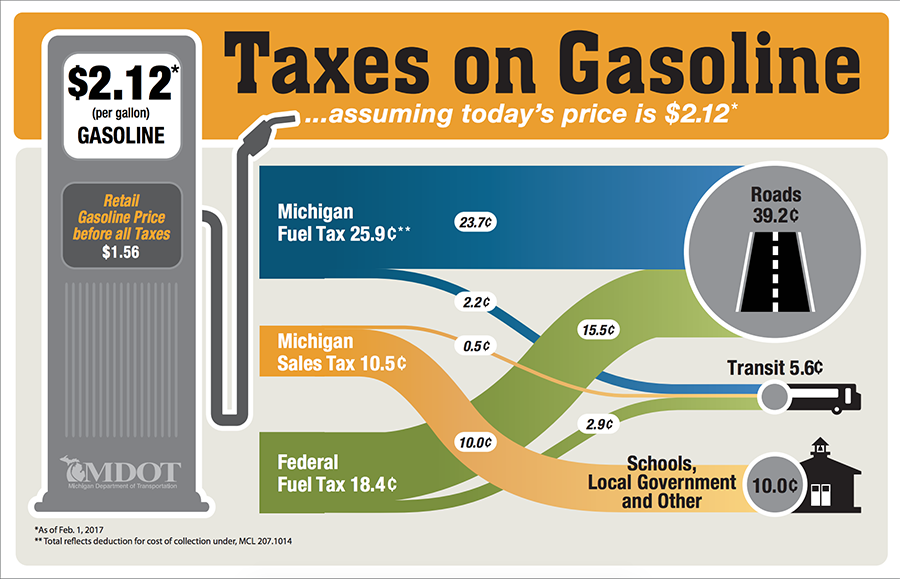

1 2020 an action she said would raise more than 2 billion annually to fix. Throw in the 184. Gasoline 272 per gallon.

4198 cents per gallon 140 greater than national average 2021 diesel tax. Fuel Tax Legislation. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247.

And Michigan with a gas-tax diversion rate of 339 is ranked with New Jersey as the third highest GTDR in the nation. Each time you purchase gasoline in Michigan youre paying a couple of road-user fees as well. And the states gas tax as a share of the total cost of a gallon of gas stood at 177 percent.

If by the end of September the annual inflation rate ends up similar to that of the previous six years the gas tax would rise from 263 cents to. As of January of this year the average price of a gallon of gasoline in Michigan was 237. For fuel purchased January 1 2017 and through December 31 2021.

What state has the highest gas tax. Listen to Free Radio Online Music Sports News Podcasts. Michigan Gas Tax Increase on Audacy.

Michigans excise tax on gasoline is ranked 17 out of the 50 states. Alternative Fuel which includes LPG 263 per gallon. 4862405 gallons 4381530 highway 480875 nonhighway.

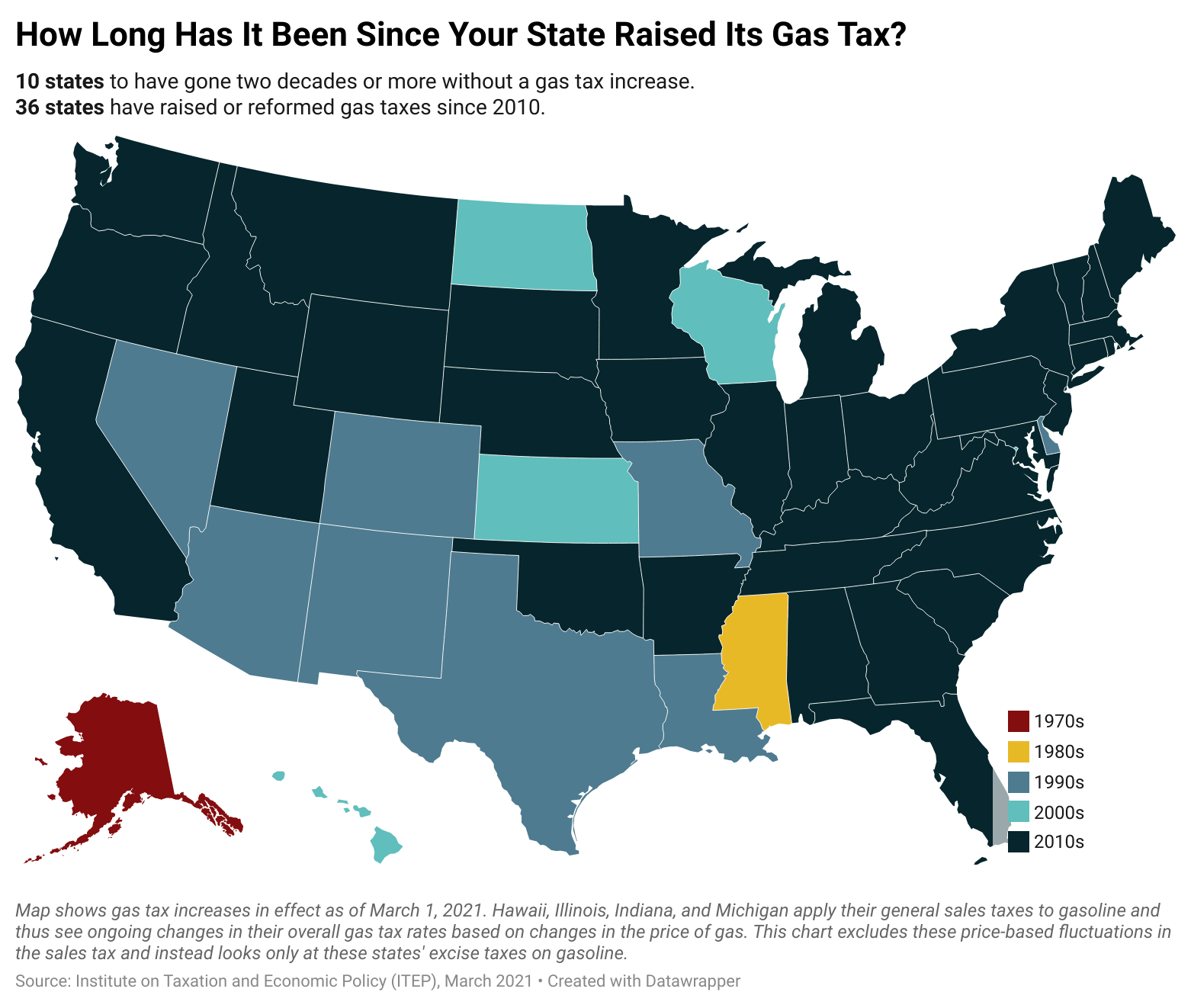

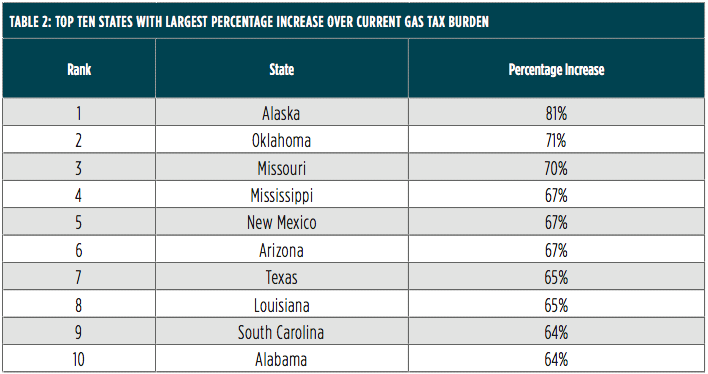

Thus far in 2021 two statesColorado and Missouri have raised their state gas tax although technically it was a fee in Colorado. Since 2013 33 states and the District of Columbia have enacted legislation to increase gas taxes. It will have a 53 increase due.

When you add up all the taxes and fees the average state gas tax is 3006 cents per gallon as of the beginning of 2021 according to the US. Talking Michigan Taxes. The current federal motor fuel tax rates are.

Michigan gas tax increase 2021 Monday March 14 2022 Edit. The excise tax would reach 413 cpg in October 2019 563 cpg in April 2020 and 713 cpg in. Michigans total gas tax the 27-cent excise tax and the 6 sales tax was the 11th highest in the nation in 2021 behind states such as.

Federal Motor Fuel Taxes. When was the last gas tax increase in Michigan. Top best answers to the question What is gas tax in michigan Answered by Mattie Stoltenberg on Tue Jul 13 2021 400 PM.

So far in 2021 inflation has been unusually high. Michigan Gas Tax 95 0190 Michigan Sales Tax 51 0102 School Aid 730 0075 Rev. Gasoline 263 per gallon.

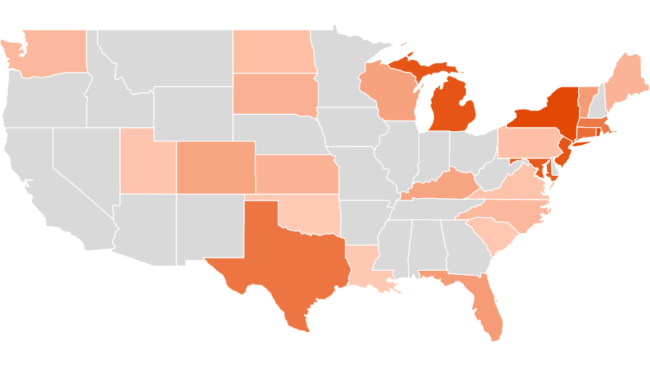

10 states to have gone two decades or more without a gas tax increase. Map shows gas tax increases in effect as of March 1 2021. Liquefied Natural Gas LNG 0243 per gallon.

Is A Michigan Gas Tax Increase Inevitable. Rick Snyder a Republican signed the increase into law in Nov. 2480 cents per gallon -327 less than national average 2021 diesel tax.

The size of the january 2022 fuel tax increase will depend on how much the consumer price index has risen between oct. Diesel Fuel 272 per gallon. The pass-through tax increase is estimated to raise roughly 203 million in total revenue in the 2020 fiscal year that starts Oct.

How Long Has It Been Since Your State Raised Its Gas Tax Itep The current state gas tax is 263 cents per gallon. In addition to state gas taxes which can make up between 5 percent and more than 20 percent of the cost of gas the federal government levies a tax of 184 cents per gallon 247. Hawaii Illinois Indiana and Michigan apply their general sales taxes to gasoline and thus see ongoing changes in their overall gas tax rates based on changes.

The 187 cents per gallon state gas tax and the 184 cents per gallon federal fuel taxWhether gas costs 2 per gallon or 4 per gallon the. Gretchen Whitmer on Tuesday proposed raising Michigans gas tax by 45 cents per gallon by Oct. 4318 cents per gallon 141 greater than national average Total gasoline use.

Diesel Fuel 263 per gallon. The Michigan Legislature upped the states gasoline tax in 2017 from 19 cpg to 263 cpg after then-Gov. What is the current Michigan gas tax.

36 states have raised or reformed gas taxes since 2010. This may well bring the annual increase close to. An analysis in June.

0183 per gallon. Federal excise tax rates on various motor fuel products are as follows. As such a 45-cent increase would bring Michigans total average gas tax to 8913 cpg by far the highest in the nation and over 30 cents higher than in Pennsylvania which currently has the highest gas tax 587 cpg.

In 2020 one stateVirginiaand DC.

Michigan Gas Prices Would Drop 50 Cents Under Senate Approved Summer Tax Cut Mlive Com

Michigan Gas Tax Going Up January 1 2022

Gov Gretchen Whitmer Signals Likely Veto On Michigan Gas Tax Holiday Bridge Michigan

Michigan Gas Tax Hike Coming In 2022

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Should We Suspend Gas Taxes To Counter High Oil Prices Econofact

Resident Information Ottawa County Road Commission

Michigan Republicans Announce Plan To Suspend State Gas Tax For Next 6 Months

Just In Time For 2021 Inflation Spike Michigan Gas Tax Getting Cost Of Living Increase Michigan Capitol Confidential

Gas Tax Vs Sales Tax On Gas Will Michigan Lawmakers Suspend Taxes For Relief At Pump Mlive Com

Gov Whitmer Vetoes Legislation To Suspend Michigan S 27 Cent Gas Tax Mlive Com

The Real State Of Michigan Roads Poor And Getting Worse Without More Cash Bridge Michigan

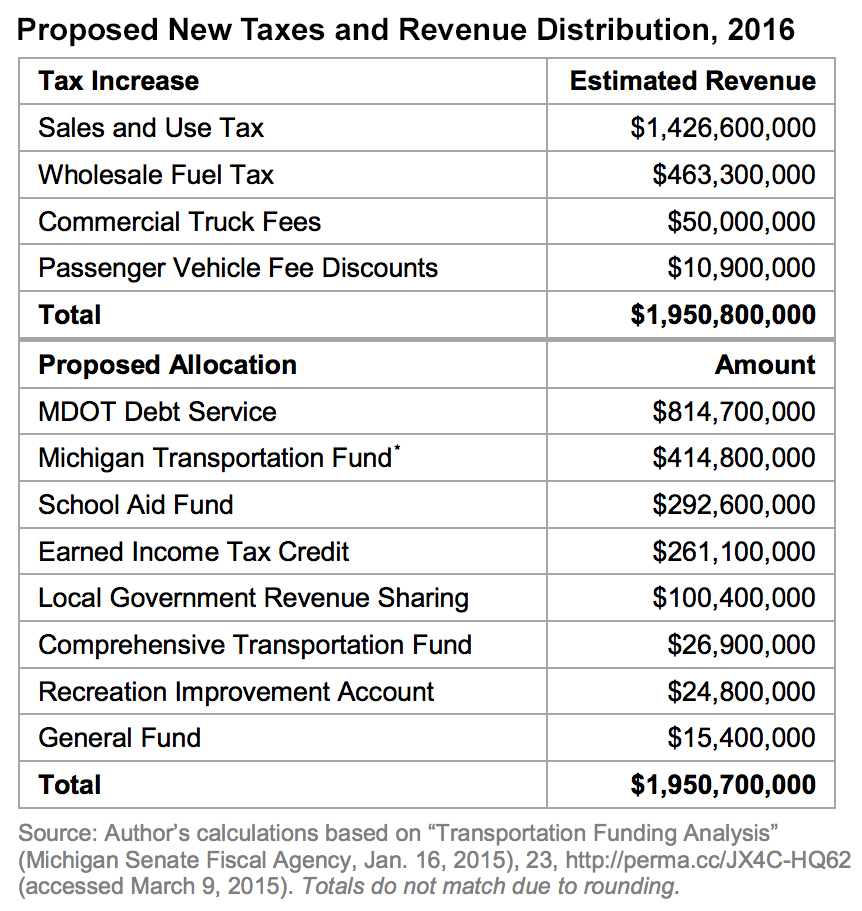

Michigan S May Tax Proposal Mackinac Center

Gas Tax By State 2022 Current State Diesel Motor Fuel Tax Rates

How Much Gas Tax Money States Divert Away From Roads Reason Foundation

Michigan S Gas Tax How Much Is On A Gallon Of Gas

Michigan S May Tax Proposal Mackinac Center

How Long Has It Been Since Your State Raised Its Gas Tax Itep

Every American Stands To Lose Under Unprecedented Gas Tax Increase